How To Successfully Navigate Retirement in South Africa

One thing all South Africans know is coming, but they’re not fully prepared for, is retirement. At some point, the life we’ve been living and the way we’ve been dividing our time will change.

If you’ve got everything in place, this change, while big, can be as smooth as possible. However, if you haven’t been preparing then you may possibly be in for quite a challenging time.

Here are the important factors you need to consider when it comes to retiring successfully in South Africa, both financially and holistically.

Factors to Consider for Successful Retirement

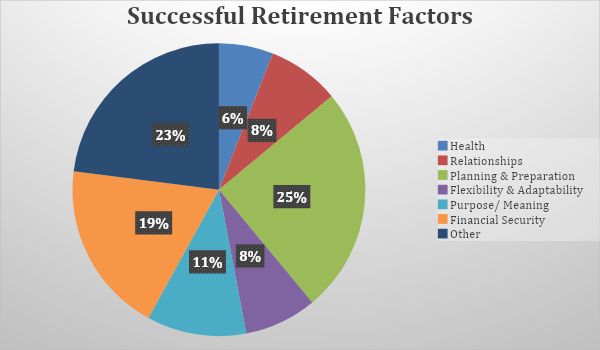

Below is a quick breakdown of the different factors to take into account with retirement. These are the factors you need to take into account and focus on to get retirement-ready:

When looking at the graph above, there are some small areas, and then there are the bigger areas which ultimately need to be a higher priority.

When it comes to retirement, the top focus is Planning & Preparation, Financial Security and Others.

Other, in general, covers everything from enjoying life to finding meaningful activities, serving others, further learning, freedom, balance, adventure, and contentment. After all, retirement is not the end of life. In fact, it’s a whole new beginning. Giving you the opportunity to explore the world in a way you’ve perhaps never had the opportunity to do before.

Read: Balancing The Debt Tightrope in South Africa

Aside from being happy and ready, you need to be sure that you are planned and prepared for the upcoming retirement. Preparation makes up 25% of the overall focus and plays a big role in a successful retirement.

With planning and preparation, you need to take into account anything and everything that you deem important. This can include being financially stable in the years to come, knowing when and where you want to retire, and understanding why and what you’re retiring to. You need to be ready for the change, adapting to a whole new lifestyle. You need to have some meaningful activities you can use to fill your days and continue to focus on maintaining good physical and mental health.

As John K. says, “The most important key to a successful retirement is planning—financially, mentally, physically, and spiritually.”

It’s important to build a life you don’t want to retire from, one with enough variety and focus that even with the removal of a day to day job, there will still be some form of routine, and more importantly, one you’re eager to keep.

Read: Growing Your Savings in SA

People always urge you to create a life you love, and the first thought the majority of us have is, ‘How do I create a life I love when I’m always working/don’t have enough time for such enjoyment?’.

You have to take stock of your day and really work out how many free hours a day are wasted on complaining or passive activities like watching TV that rarely bring you joy. If you’re looking to have a blast with retirement, then you’ve got to put in the work and planning to make sure it will be unforgettable.

Financial Focus for Retirement

Another primary focus point is being not just financially stable but also financially secure. Ideally, you want to start investing and saving for your retirement as early as possible. Maybe even as soon as you start working and earning your own income.

If you’re not financially prepared for retirement, it will result in more stress and less enjoyment. So make sure you’ve prepared enough for retirement before the time comes, and you’re not given the opportunity to enjoy retirement the way you’re supposed to.

Ways to prepare financially:

- Save 20% of your income as early on as possible

- Plan for Healthcare expenses

- Create a budget

- Start saving as early as possible

- Have a diversity of investments

- Have a regular retirement plan review and make any changes necessary

- Pay off debts as soon as possible

- Make planning a habit

- Set up your will

Set Your Budget

Let’s face it: the past few years have been financially straining for the majority of South Africans. With a pandemic, inflation and interest rates pushing struggling south Africans even further off the debt cliff and getting those with higher income dipping their toes in the debt pool for the first time.

No matter how well you’ve budgeted, there’s always room for improvement or changes. You may have budgeted for a certain lifestyle that you can no longer afford during retirement, or you may have extra savings that give you the freedom to do more now in your old age than what you were used to during your regular working days.

Read: Set Your Sights on Success

No matter how you look at it, it is important to set up a budget and be fully aware of how much you have for housing, food, other expenses and entertainment. Plan it right, and you’ll have enough to treat yourself often or even take your family for a special lunch or dinner.

Be Flexible

There are some areas of retirement you want to have planned and prepped to a T. But when it comes to new life after retirement, you may want to take a more flexible approach. There are no more set hours of having to work 8 hours a day.

In fact, you can pack up your bags and travel only for the first year of your retirement if you want to. The important thing is to be flexible and meet the moment head-on.

Read: 4 Tips to Spring Clean Your Finances

You’ll have to ride the rollercoaster of emotions in the first couple of months after retirement. For this, make sure you have some healthy activities and processing methods to keep you from spiralling or even spilling your emotions in an unhealthy way.

Healthy activities:

- Yoga

- Writing

- Drawing

- Reading

- Chats with others

- Walking

There are only a couple of activities that are good for your mental and physical health and can assist in coping with your emotions. If you don’t work through your emotions, you may end up eating your feelings or developing unhealthy habits that will lead to the deterioration of your health.

Social Interaction

Just because you are retiring doesn’t mean your social life does, either. While you’re still young, you need to put more focus and effort into your friendships. Once you are retired, isolation can knock you unexpectedly. Suddenly, you can find yourself feeling down in the dumps with nobody to comfort you or get your mind off the issue.

If you have a solid friend group, this won’t be as scary or traumatic. You can add outings with your friends to your list of weekly activities. Meet one friend for lunch on a Monday, take a walk with another friend a couple of times a week and have regular coffee dates with another.

Read: 15 Money Tips for the Working South African

For every friend, there’s a moment or an activity, and you may even have space for some spontaneous meetups that keep you both young. The important thing is to remain socially active and not just withdraw from the world.

If you don’t have a stable friend group, you may want to start building one. Start by doing small things like joining programs at your local community centre or church. You never know how many interesting people you may meet, even some who share your interests and hobbies.

Daily Activities During Retirement

There are plenty of things you can do when you’re retired, such as getting involved more with the community in big ways. You can volunteer at an animal shelter or animal rescue, offer tutoring in your field of work or areas in which you qualify, take part in food drives and other missions dedicated to helping the less fortunate, or mentor those younger than you.

A great way to get involved is by volunteering at your church for the different weekly or monthly missions. Get actively involved with the community rather early on in life, so when you’re older it won’t be as much of a challenge, and you will already have a solid foundation you can build on.

Get a Side Hustle

Some people have to retire but are not yet ready to face a life where they aren’t busy with something productive for a couple of hours a day. For these people, it’s a good idea to build a side hustle from an early stage.

Read: Everything You Need To Know About Retiring with Debt in SA

So even if it’s time to retire from your full-time job, you still have your side hustle, which you can grow and expand thanks to the hours you’ve regained from being at the office. Even if it’s as simple as being a clerk in a bookstore, it has been proven that retirees who do some form of work after retirement have higher levels of life satisfaction and are in a better state mentally and physically.

Clear the Road with Debtline

Before you can go into retirement, you want to take care of all the nitty gritty things that may have some sort of impact on your retirement relaxation. If you’ve got some debts built up and you are eager to get into debt-free living so you can make your way towards a peaceful retirement, then you want to contact Debtline.

Debtline is a debt solution that can assist you with various things, including advice and assistance from NCR registered counsellors, providing you with a debt relief program that meets your needs, advisors who negotiate debt repayments on your behalf, and protection as you undergo Debt Review. Become debt-free by requesting a free callback or sending an email to [email protected].